First-Time Home Buyer Savings Accounts

Top 5 FAQs

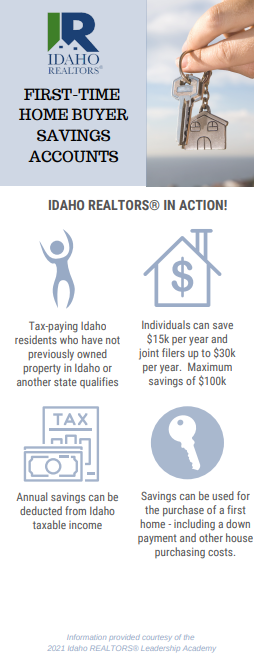

1. Who qualifies? Any tax-paying Idaho resident or their Idaho spouse who hasn’t previously owned property in Idaho or any other state.

2. What banks and credit unions are participating?

- First Federal Savings Bank

- Bank of Commerce

- Willamette Valley Bank

- Idaho Central Credit Union

- CapEd

- Westmark Credit Union

Don’t see your bank or credit union? Ask them today about opening a FTHB Savings Account.

3. What are the limits? Individual tax-payers can save up to $15,000 a year and joint filers can save up to $30,000 a year for the eventual purchase of their first home. Annual savings can be deducted from their Idaho taxable income. The limit on the savings account is $100,000.

4. What can the savings be used for? Funds can be saved for the eventual purchase of a home. That includes down-payment, appraisal costs, closing costs and more (anything associated with closing on their first home).

5. Who may I contact with additional questions? Email Max Pond at mpond@idahorealtors.com or call (208) 342-3585.

First-Time Home Buyer Savings Account Ad Campaign

Thank you to Idaho REALTORS® 2020-2021 Leadership Academy for developing these informative and easy to read infographics as a part of their class project! These are great to share with your clients to help explain First-Time Home Buyer Savings Accounts.

*Downloads Available Below*

First-Time Home Buyer Savings Accounts: Bill H589 was passed this year!

Similar to existing Idaho tax-advantaged savings accounts for healthcare and education, Idaho’s First-time Home Buyer Savings Accounts encourage individuals to save for their first home, including down-payments, or other eligible costs associated with closing on their first home in Idaho.